Share

Attention Brands: Why Black Friday and Cyber Monday Shouldn’t Be Your End-all Be-all in Q4

Whether we’re talking e-commerce or in-store foot traffic, it should be a surprise to no one familiar with how calendars work that the fourth quarter is the most action-packed time of the year for almost every kind of brand. Along with increases in holiday shopping come marketing tactics that get more and more innovative each and every year.

For decades, we had Black Friday. Now, we’ve added Cyber Monday to that mix and in both cases, the deals can go from reasonable to absolutely absurd. It’s the time of year where literally every consumer is locked in. Brands try to take full advantage of that. We at Advertise Purple begin thinking about this time of year ahead of time to make sure all of our clients are good to go.

Think about it. U.S. shoppers are gearing up to spend $142 billion on holiday goods and gifts online this year.

That’s over $13 billion more than the GDP of Puerto Rico. And that’s only the online spend. If you couple that with in-store shopping traffic, we’re looking at historically high spikes in distribution of disposable income over the course of the Fall and Winter seasons.

But during “the most wonderful time of the year”, it’s important to think about much more than just Black Friday and Cyber Monday:

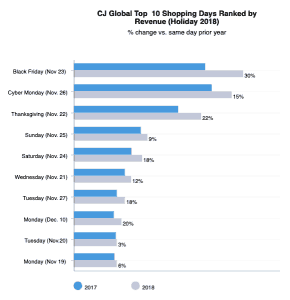

As you can see, according to numbers from Commission Junction, Cyber Monday and Black Friday saw revenue increases from 2017-2018, but so did many other key dates around this time.

One of the key takeaways CJ made was that this year Thanksgiving falls on November 28. This reduces the days between Thanksgiving and Christmas to 27 days. Marketers are going to have to anticipate heavier shopping in November and early December to compensate.

Other days of note surrounding Black Friday and Cyber Monday include Thanksgiving itself (I know I’d rather shop online than hang out with my family), Free Shipping Day, Boxing Day, and Christmas Day. Conversion rates were at 10% for Cyber Monday and 9% for Black Friday. For those other days, we saw 7% (Thanksgiving and Free Shipping Day) as well as 6% on Christmas Day and 5% on Boxing Day.

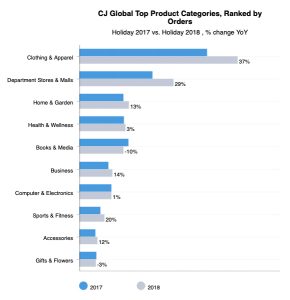

CJ also put together a breakdown of orders based on product. It looked like this:

An interesting element to this data is that they found people don’t only buy gifts around this time. Household and year-round items (boring stuff like toilet paper and deodorant) go up in sales too. So, rather than focusing on gift-i-fying your inventory, you can rest assured if your products are good, they will sell in Q4.

The bottom line is that thinking beyond Black Friday will benefit you in the end. Most importantly, it’s necessary to think about the first three weeks of December and possibly early November as well.

Stay tuned to learn more about the affiliate marketing space and key trends going into the end of 2019 and beyond!