Share

Takeaways and Insights From Historic Black Friday & Cyber Monday

Okay, I know I’m not the first person to tell you 2020 is ‘unprecedented’. You’ve heard it a million times at this point.

But do you want to know something about 2020 that actually has a precedent? It’s that regardless of the state of the world, people love finding and securing the best deals imaginable in and around the holiday shopping season.

That’s a fact that probably will never change! Which is a good thing for brands who position themselves nicely with their marketing around the holidays.

While some recall it being just Friday, the string of days immediately after Thanksgiving, referred to fondly as Black Friday, Cyber Monday, and now even ‘Cyber Week’ or weekend has stolen the show for not just holiday gifts but enticing deals on almost all types of products.

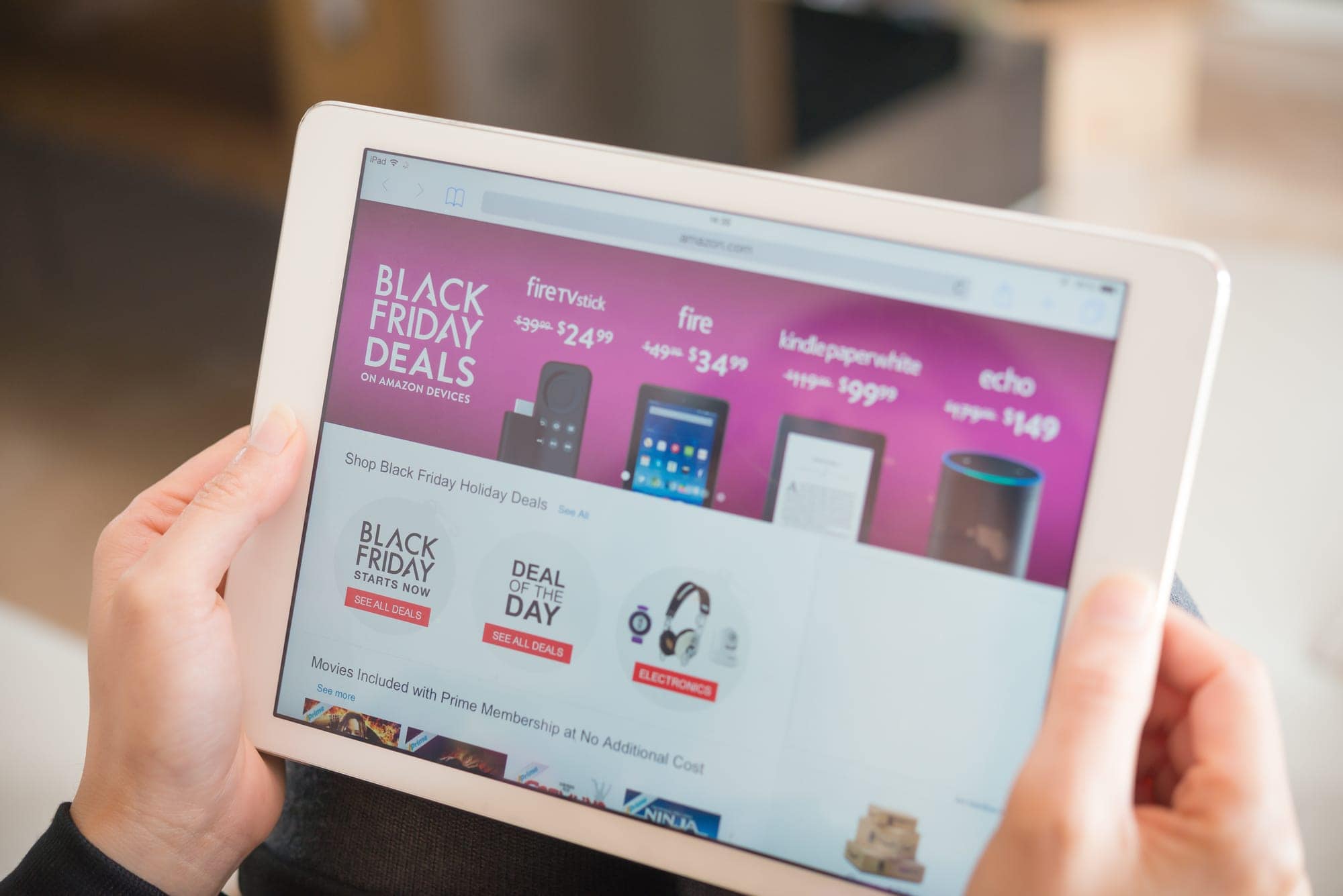

There was certainly a noticeable dip in brick and mortar shopping, although some malls and shopping centers stayed open despite COVID-19 surges. A combination of innovation around online shopping and the Coronavirus this year kept people out of long lines and in stores.

The numbers you need to know

All of that being said, Black Friday weekend was all about e-commerce. Yahoo reported that “online sales rose more than 23 percent, crossing $6 billion on Black Friday, according to data from Adobe Analytics.

On Thanksgiving, it’s estimated sales grew 28 percent to $3.7 billion. The growth continued through the weekend. CNBC reports that Cyber Monday hit a record $7.9 billion in sales, which is an increase of 19.3 percent from a year ago, according to data from Adobe Analytics.

Holiday sales are at their peak, according to Business Insider, as Adobe Analytics is predicting sales to be the biggest in U.S. history.

The cultural shift from a stressful experience to a simple one lures in more shoppers

Some recall a past of some relatives “braving” Black Friday lines and getting up early to go look for deals at major department stores even while perhaps nursing a hangover from the adult beverages and tryptophan consumed the day prior.

But a subtle difference now is that the deals are still attainable from one’s laptop in the safety of their own home sitting cozily next to the fire.

On top of increasing online sales, you could say the current landscape has certainly stopped many from duking it out for the latest video game systems and the like in person, with the online experience adequately replacing the deal-seeking craziness.

In most people’s opinions, this change is for the better. That is, unless you have fond memories of getting a black eye trying to track down a Furby for your nephew back in the day (or so I heard… I was the nephew, and hey, I played with the Furby for a few weeks).

Some key takeaways from this Black Friday/Cyber Monday

Your Black Friday selling strategy doesn’t have to be limited to just one day. It’s now a four-day online shopping marathon. Take advantage of the fact that you’ve got shoppers ready and raring to think of things they might need. Attract them with your products, not just ridiculous price cuts.

Next, having an omnichannel solution is vital to creating a seamless shopping experience for the abundance of in-store and e-commerce consumers. Convenience-driven features like Buy Online, Pick Up in Store were the clear winners.

You need a mobile POS solution. Online shopping won because consumers don’t want to wait in long lines or face a stampede. Providing an easier, faster checkout is key.

Give back: Old Navy offered socks for $1 in store and for every pair purchased they donated $1 to the Boys and Girls Club.

Keep up your marketing efforts late in the night. According to ChainStoreAge, “the three hours between 10:00 p.m. and 1:00 a.m. ET on Cyber Monday were expected to drive $1.7 billion in online sales, roughly $300 million more than an average full day during the year.”

Advertise Purple affiliate marketing data further highlighting the success of this period

When comparing 2020’s Black Friday thru Cyber Monday period with 2019’s in our proprietary data, we saw:

- 41% increase in clicks/traffic

- 53% increase in orders

- A whopping 50% increase in revenue across the board

- About a 7% increase in conversion rate

The verticals with the most success were:

- Home & Living

- Apparel & Fashion

- Sleep

- Computer, Electronics & Software

- Food & Beverage

- Beauty

- Sports & Outdoors

- Health & Wellness

- Accessories & Jewelry

- Education

—

We hope you’re successfully tackling Q4 and seeing success with your affiliate marketing program. If you’re interested in working with us or think you could use some support with the affiliate channel, please feel free to reach out at [email protected].